tucson sales tax rate 2019

On July 15 2019 the Mayor and the Council of the City of South Tucson approved Ordinance No. Effective October 1 2019.

Arizona Sales Tax Guide And Calculator 2022 Taxjar

19-01 to increase the following tax rates.

. Effective July 1 2017 the rate will rise from 20 to 25 increasing the total retail sales tax rate in Tucson AZ from 81 to 86. Start your free trial. Learn more about the 2019 Hyundai Tucson.

Arizona Tax Rate Look Up Resource. Automate your businesss sales taxes. Select the appropriate business description and the statecounty and city if.

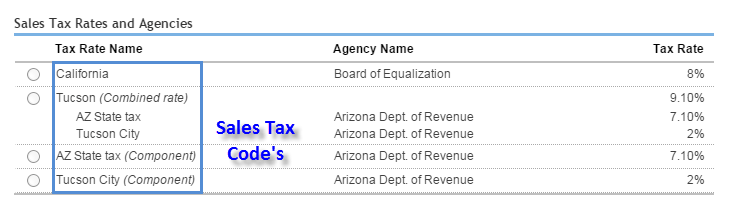

Our partner TaxJar can manage your sales tax calculations returns and filing for you so you dont need to worry about mistakes or deadlines. The Tucson Arizona sales tax is 860 consisting of 560 Arizona state sales tax and 300 Tucson local sales taxesThe local sales tax consists of a 050 county sales tax and a 250 city sales tax. On May 16 2017 Tucson resident voters approved a 5-year half-cent increase to the City of Tucson sales tax rate.

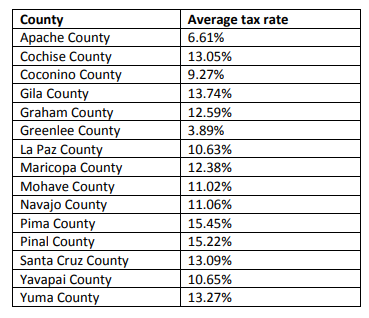

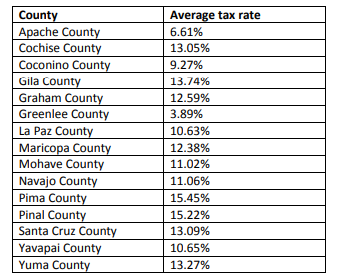

Arizona sales tax rate change and sales tax rule tracker. South Tucsons sales tax increase felt most by businesses residents. Maricopa County Local General Sales Tax AZ State Sales Tax Apache Junction 400 560 Avondale 320 560 Buckeye 370 560 Carefree 370 560.

610 Is this data incorrect Download all Arizona sales tax rates by zip code. Average Sales Tax With Local. These rates went into effect December 1 2021.

Sales Tax Increase Effective October 1 2019 Methods of Notification. 1 TPT News and Updates Newsletters which is placed on the website social media and GovDelivery every 20th or so of the. Effective July 01 2003 the tax rate increased to 600.

October 2019 CITY OF SOUTH TUCSON. Imposes a 400 transient rental tax on rent from persons renting accommodations for less than 30 consecutive days and a 1 per night charge per room rented but not as a part of the model tax code. To review the rules in Arizona visit our state-by-state guide.

Kelley Blue Book users rate the 2019 Hyundai Tucson. Groceries are exempt from the Tucson and Arizona state sales taxes. On July 15 2019 the Mayor and the Council of the City.

Updated Jul 22 2019. This change has an effective date of October 01. The December 2020 total local sales tax rate was also 8700.

2020 rates included for use while preparing your income tax deduction. Effective July 01 2009 the per room per night surcharge will be 2. There are a total of 99 local tax jurisdictions across the state collecting an average local tax of 241.

Arizona has state sales tax of 56 and allows local governments to collect a local option sales tax of up to 53. Retail Sales 017 to five percent 500 Communications 005 to five and one-half percent 550 and Utilities 004 to five and one-half percent 550. As evidenced by the following rate change.

Commercial rental leasing and licensing for use. On October 19 2021 the City of Tucson Mayor and Council voted to implement a differential rate structure for Tucson Water customers located in unincorporated Pima County. Get 2019 Hyundai Tucson values consumer reviews safety ratings and find cars for sale near you.

The Pima County Arizona sales tax is 610 consisting of 560 Arizona state sales tax and 050 Pima County local sales taxesThe local sales tax consists of a 050 county sales tax. The Pima County sales tax rate is. Use the physical address or the zip code or if it is unknown the Map Locator link can be used to find the location.

Ad Try Returns For Small Business Avalaras low cost solution built for omnichannel sellers. Automating sales tax compliance can help your business keep compliant with changing sales. The latest sales tax rate for Tucson AZ.

The 2018 United States Supreme Court decision in South Dakota v. The City of South Tucson primary property tax rate for Fiscal Year 2017-2018 was adopted by Mayor Council at 02487 per hundred dollar valuation. The local tax rate in Tucson is 26 on the following business classifications.

Has impacted many state nexus laws and sales tax collection requirements. The Tucson Sales Tax is collected by the merchant on all qualifying sales made within Tucson. KOLD News 13 - The City of South Tucson city council narrowly approved a measure increasing the citys sales tax rate to 11 percent on Monday leaving citizens and local business owners scrambling to cope.

Just 19month for preparation and 25 per optional auto filing. The current water rates and charges were adopted by the Tucsons Mayor and Council on May 22 2018 and became effective July 1 2019. Review Arizona state city and county sales tax changes.

This change has no impact on Arizona use tax assessment which remains at 56. 18 2019 at 524 PM MST. This rate includes any state county city and local sales taxes.

On January 1 2019. The decision on Tuesday raises the total sales tax inside the square-mile city to 111 compared to the city of Tucsons total sales tax rate of 87. This resource can be used to find the transaction privilege tax rates for any location within the State of Arizona.

New 2022 threshold amounts for the retail sales and use tax two-level tax rate structure as approved by Phoenix voters with Proposition 104 in the August 25 2015 city elections will go into effect January 1 2022.

State And Local Taxes In Arizona Lexology

2021 Arizona Car Sales Tax Calculator Valley Chevy

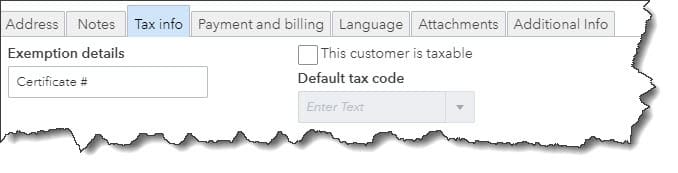

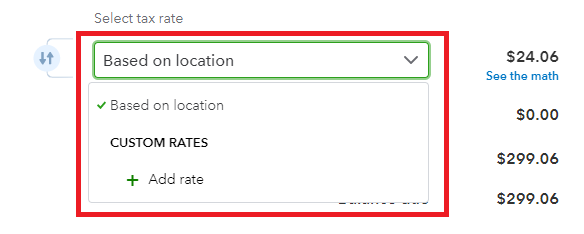

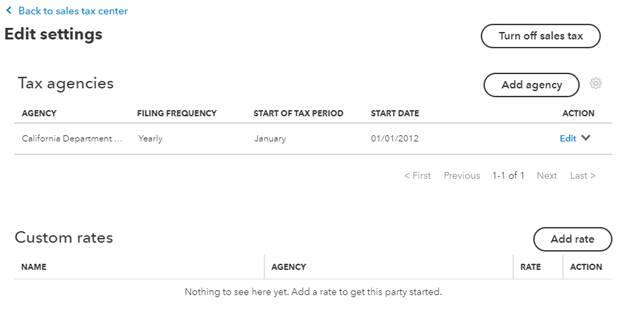

Import Transactions With Sales Tax For U S Quickbooks Online Companies Saasant Blog

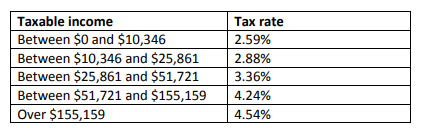

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

5 Things You Need To Know About Sales Tax In Quickbooks Online

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

Property Taxes In Arizona Lexology

Arizona State Taxes 2021 Income And Sales Tax Rates Bankrate

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

How To Process Sales Tax In Quickbooks Online

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

How To Calculate Sales Tax For Your Online Store

How To Process Sales Tax In Quickbooks Online

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation